Austin MSA Real Estate Trends + Manor, TX — MLS Data for August 2025

The Fed Conversation and the local Austin Market

The Austin–Round Rock–San Marcos metro continues to recalibrate after the 2021–2023 surge. As of August 2025, pricing is broadly stable while inventory edges higher and leasing remains active—signs of a market moving toward balance rather than boom-and-bust. Below, I unpack what the newest Unlock MLS snapshots reveal for sales and leases, what this means for buyers and sellers (including those focused on Manor, TX), and how today’s Federal Reserve rate discussion could shape fall activity.

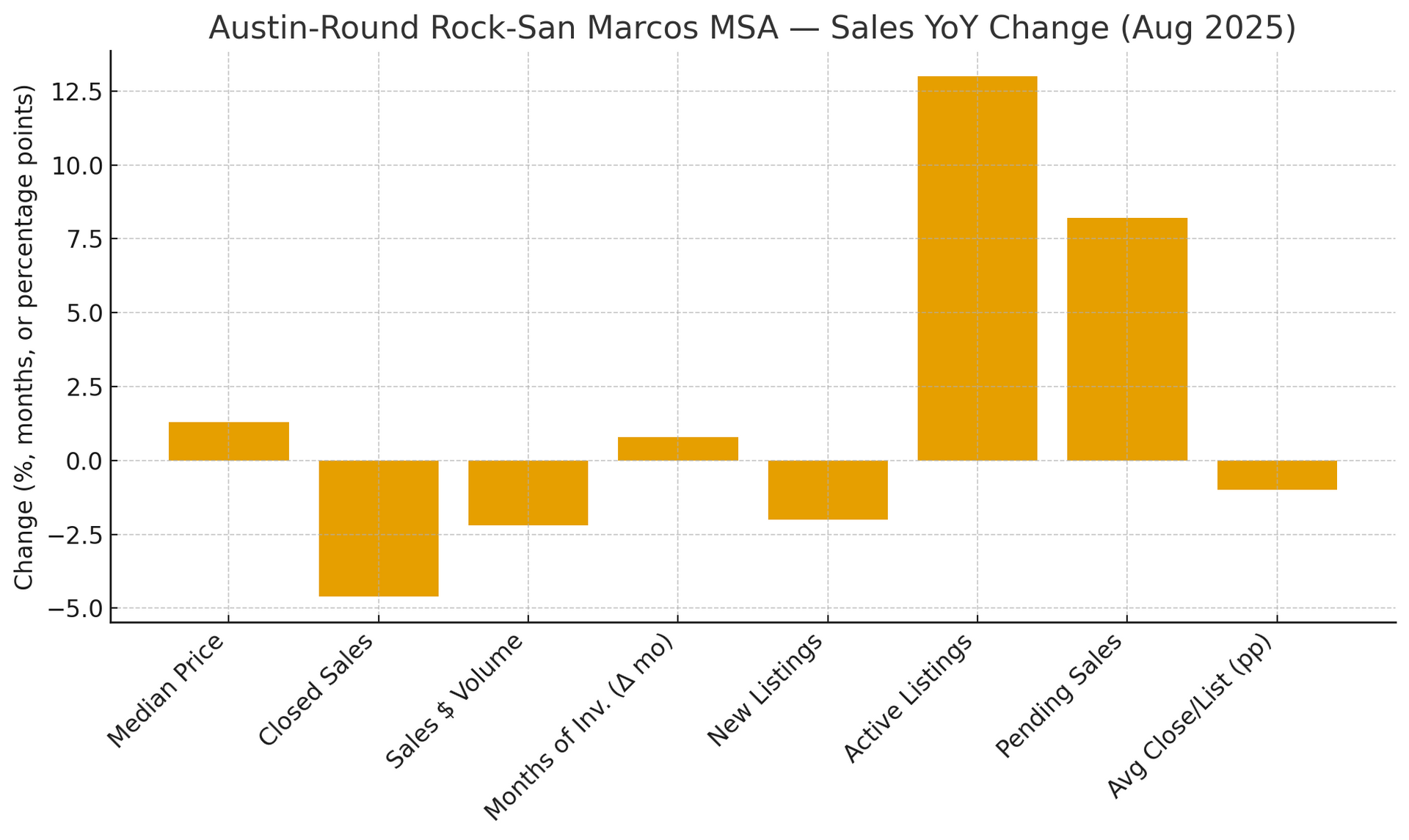

Headline takeaways (Austin MSA — Sales)

- Prices: Metro median sales price $444,490 (+1.3% YoY).

- Demand & velocity: Closed sales 2,545 (–4.6%); pending sales +8.2% point to firmer fall demand.

- Supply: Active listings 14,220 (+13.0%) and months of inventory 5.9 (up 0.8 months).

- Pricing power: Average close-to-list 92.3% (down 1.0 pp YoY), and DOM 68 (up 7 days).

These figures describe a negotiation-friendly, price-stable market: buyers have more choice and time; sellers still achieve solid prices when homes show well and are correctly positioned.

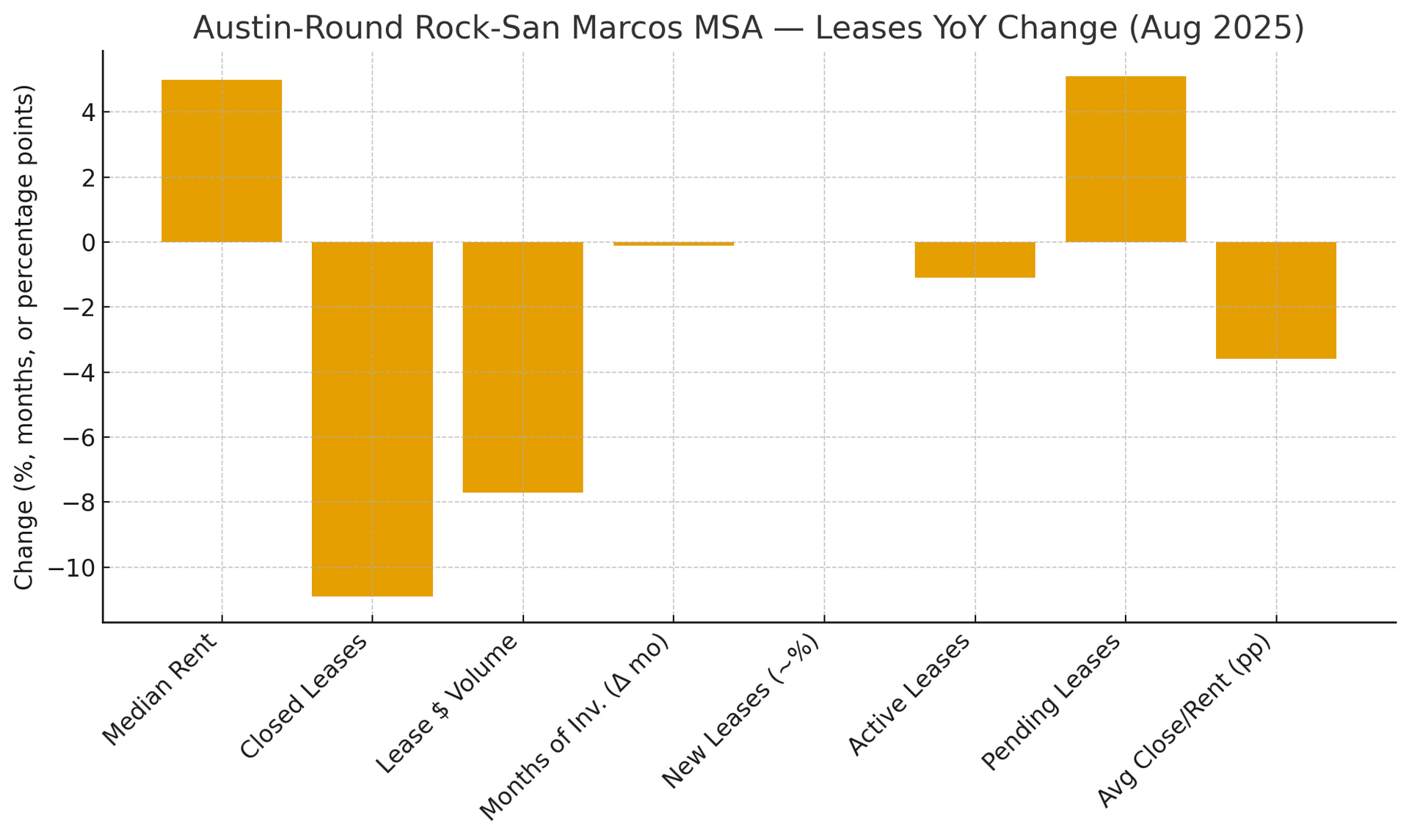

To visualize the YoY shifts, see the charts rendered above (sales and leases).

County notes (for neighborhood context, including Manor)

- Travis County (home to Manor): Median $525,000 (+4.4%); pending sales +11.8%; inventory 6.9 months(↑0.8). Buyers near Manor are seeing more options with a modest price uptrend—good for move-up shoppers and relocation clients weighing value vs. commute.

- Williamson County: Median $425,000 (≈flat); inventory 5.4 months; active listings +20.8%—a deep bench of choices.

- Hays County: Median $369,000 (–3.4%) with inventory 4.8 months—value seekers take note.

- Bastrop County: Median $366,000 (–16.6%), inventory 7.4 months—the most buyer-friendly conditions in the MSA this month.

- City of Austin: Median $590,000 (+1.7%), inventory 6.3 months, pending +16.3%—core demand is re-accelerating even as choices expand.

Implication for Manor: With Manor’s proximity to Austin, ABIA, and nearby cities, the Travis County uptick in pending sales suggests fall closings will firm. Expect competitively priced, well-prepared homes in Manor to draw steady traffic, while over-ambitious list prices meet longer DOM.

Leasing snapshot (Austin MSA — Leases)

- Median rent $2,362 (+5.0%);

- Closed leases –10.9% and lease $ volume –7.7%;

- Active leases –1.1%, pending leases +5.1%;

- Months of lease inventory 2.6 (–0.1 mo); Avg days on market 41 (–1 day).

Rents are firm to rising, even as fewer leases close. For would-be buyers delaying a purchase, holding costs are not falling—a subtle nudge toward ownership where monthly payments pencil.

What buyers and sellers should do now

For buyers (first-time, move-up, and relocations):

- Use the growing inventory to compare across submarkets (Manor vs. nearby East/NE Austin, Pflugerville, Elgin).

- Leverage longer DOM and the lower close-to-list ratio to seek seller credits for rate buydowns or closing costs—especially effective on listings with recent price reductions.

- For new construction, keep momentum but “hasten slowly”—move forward with informed choices and clarity on incentives and timelines.

For sellers:

- Pricing precision matters: set within 1–2% of market to avoid the “stale-listing discount.”

- Invest in presentation (repairs, paint, landscaping) to protect the close-to-list ratio.

- Consider concessions (e.g., rate buydown) as strategic tools rather than across-the-board price cuts.

Today’s Fed conversation: what it may mean locally

Markets widely expect the Federal Reserve to begin cutting the policy rate this week (≈25 bps, with risk of 50 bps)after a nine-month pause, given cooling labor data and moderated inflation. Bond desks are positioning for a steeper curve and longer duration, consistent with a lower-rate path ahead. Some analysts also argue that slowing the Fed’s MBS runoff could narrow mortgage spreads and trim mortgage rates by 20–30 bps—an effect akin to a larger policy cut.

Local impact:

- If the Fed cuts 25–50 bps, expect incremental relief in mortgage rates; paired with abundant inventory, this should support fall absorption (note MSA pending +8.2% already).

- Should the Fed also signal flexibility on MBS reinvestment, Austin MSA could see quicker rate pass-throughto mortgages—benefiting first-time buyers in Manor and across Travis County.

- Regardless, buyers should model payments at current rates and treat any drop as upside; sellers should prepare for steady, not sudden, demand gains.

Outlook (expert view)

- Base case (Q4 2025): Gradual rate relief + stable-to-modestly rising prices. Pending sales momentum suggests a firmer fourth quarter, especially in submarkets with new inventory at approachable price points (e.g., Manor/NE Travis, parts of Hays).

- Upside: Larger-than-expected rate cuts or narrowed mortgage spreads could unlock “rate-locked” move-up sellers, normalizing turnover and supporting price resilience.

- Downside: If employment softens materially, buyers may stay cautious despite lower rates, keeping close-to-list ratios in the low-92% range and extending DOM.

Request a free buyer guide for tailored strategies and neighborhood comps—and let’s schedule a 15-minute buyer consult to align budget, timing, and target communities.