5 Hidden Costs of Buying a Home in Austin (and How to Prepare)

Spoiler Alert: The Real Price Tag Isn’t on Zillow

Buying a home in Austin is an exciting milestone. With its vibrant culture, strong job market, and desirable neighborhoods, Austin continues to attract buyers from near and far. Yet while most first-time and seasoned buyers focus on the purchase price and down payment, many are surprised by the hidden home buying costs Austintransactions often bring. Preparing for these expenses can make the difference between a smooth closing and a stressful scramble.

Below, we’ll explore five of the most common hidden costs in TX real estate closing costs, and how you can be ready for them.

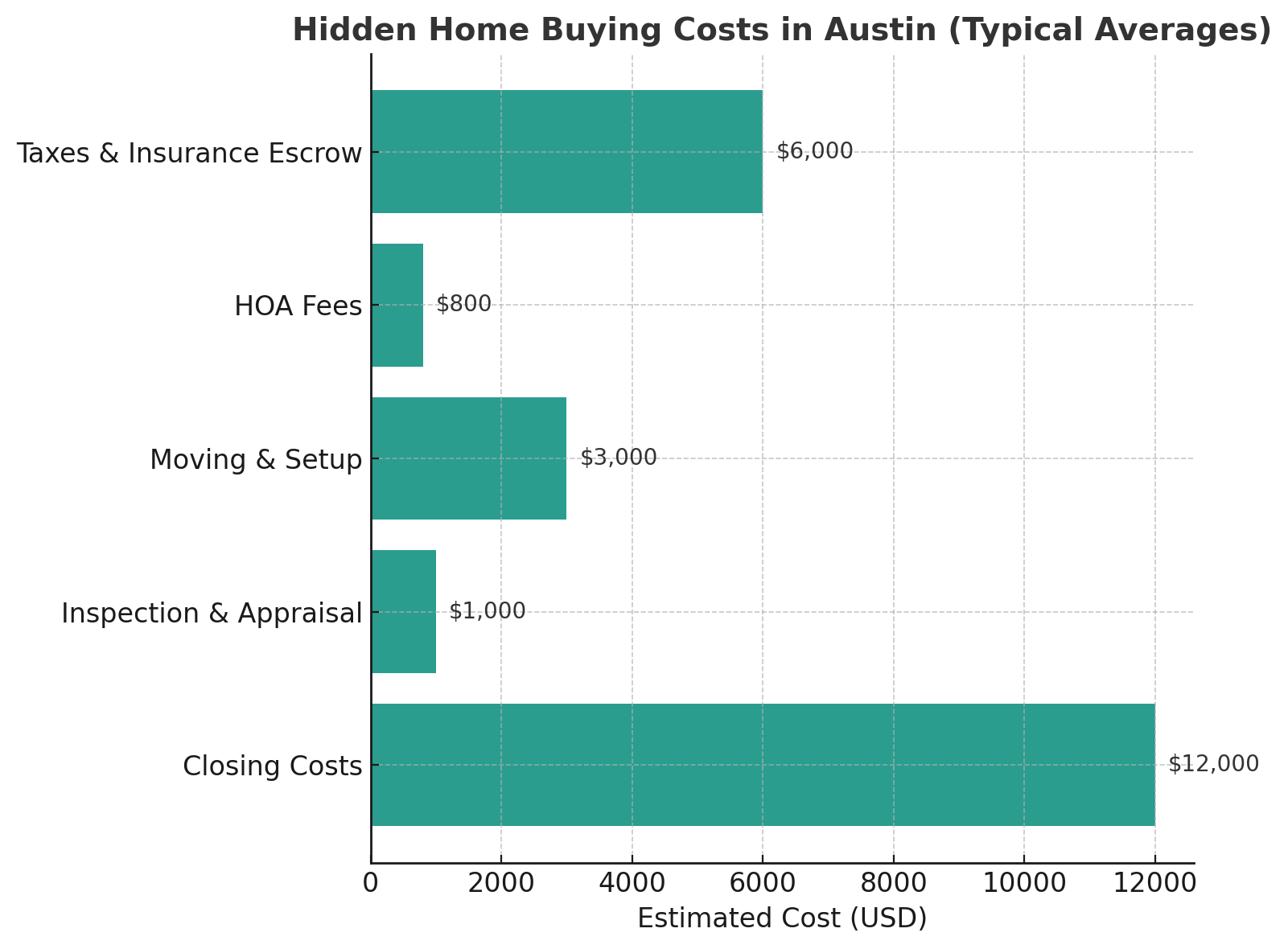

1. Closing Costs Beyond the Down Payment

When budgeting, buyers often overlook the full scope of closing costs. In Texas, these can include title searches, loan origination fees, survey costs, and attorney fees. Expect these to range between 2–5% of the purchase price.

How to prepare: Request a detailed closing cost estimate early in the process. A trusted buyer’s agent can review the breakdown with you and flag negotiable items. Some lenders or sellers may even offer credits to offset these costs.

2. Inspection and Appraisal Fees

Before finalizing a purchase, lenders and buyers need professional evaluations of the property. Appraisals generally cost $500–$700, while inspections can add $300–$600, depending on the home’s size and systems. Specialized inspections—such as for septic tanks, pools, or foundations—can cost more.

How to prepare: Set aside at least $1,000 for inspections and appraisals. These costs are upfront and typically nonrefundable but are crucial for avoiding costly surprises down the road.

3. Moving and Immediate Home Setup

Even with careful planning, moving expenses creep higher than expected. Hiring movers, setting up utilities, purchasing blinds or curtains, and buying appliances (if not included in the sale) can quickly add several thousand dollars.

How to prepare: Build a move-in fund of $2,000–$4,000. Austin’s hot summers also make HVAC tune-ups and utility deposits common early expenses.

4. Homeowners Association (HOA) Fees and Reserves

Many Austin neighborhoods—especially newer developments—require HOA dues. These may cover landscaping, pools, and shared amenities, but initial “reserves” or transfer fees are often due at closing.

How to prepare: Ask upfront about HOA monthly dues and one-time transfer fees. Some range from $300–$1,000 annually, with reserves due at closing.

5. Property Taxes and Insurance Escrow

Texas has no state income tax, but property taxes are among the highest in the nation. Travis County and surrounding areas typically fall between 1.7–2.2% of assessed value annually. Lenders often require several months of taxes and homeowners insurance premiums to be paid upfront into escrow.

How to prepare: Estimate your property tax bill based on local rates and factor in homeowners insurance ($1,200–$2,500 annually). Having extra savings ensures you won’t be caught off guard when these are collected at closing.

Practical Tips to Stay Ahead

- Get pre-approved with full transparency: A lender-prepared estimate will outline many fees.

- Work with a buyer’s agent: Representation ensures someone is advocating for your best interests, especially with hidden costs.

- Budget beyond the purchase price: Plan for at least 3–5% of the home’s price in additional costs.

- Ask about seller concessions: In some markets, sellers may contribute toward your closing costs.

Why Planning Matters in Austin

With Austin’s competitive housing market, preparation is everything. By budgeting for hidden expenses, you’ll protect yourself from surprises and feel confident making offers in a city where homes often move quickly.

Whether you’re buying your first home, moving up, or relocating to Austin, knowing the hidden home buying costs Austin buyers face will keep you a step ahead.

Final Thoughts

Buying a home in Austin is a significant investment, and understanding closing costs TX real estate transactions typically include ensures you’re financially prepared. Think beyond the sticker price, and you’ll enjoy the excitement of homeownership without the stress of unexpected bills.

Ready to see a clear picture of what your costs will look like? Send text to 678-557-4102 with "Closing"